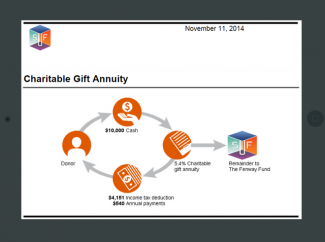

charitable gift annuity administration

The charitable deduction is for just a portion of the face amountthe benefactor retains rights to the portion that will be paid out so the full amount. The ACGAs new single-life rates are 04 to 05 lower than the rates that went into effect on January 1 2020 and the new two-life rates are 03 to 05 lower.

At death the non-profit organization retains the use of any unused principal and interest.

. A charitable gift annuity CGA is a simple agreement between an individual and a non-profit organization. The Charitable Gift Annuity can satisfy the desire to make gifts while still living to improve retirement cash flow. Learn more about our services by reaching out to us today.

A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. Your one-stop shop for charitable gift services. By providing expertise on tax reporting contribution processing.

A charitable gift annuity is an arrangement for a series of income payments for life to be paid to an individual in return for a donation of assets. There cannot be more than two annuitants. Ren delivers planned-giving administrative services tailored to meet your needs.

A charitable gift annuity CGA provides a fixed lifetime income payment to you as the donor s or to one or two life income beneficiaries annuitants you may designate. Meridian St Suite 700 PO. If you wish payments can go to a family member or friend instead.

3 This scenario differs from a direct beneficiary designation from an IRA to either an individual non-spouse or a charity by combining features. Charitable Gift Annunity Administration Establish CGA administrative pools for efficient monitoring and payment management. 2 The new rate schedules retain the 50 target residuum and continue the requirement first applied for the July 2011 rate schedules that the present value PV of the residuum be at.

A CGA delivers fixed income for life immediate tax benefits and a charitable gift to ministry. Many charitable and religious organizations will accept gifts for charitable gift annuities and then purchase an immediate annuity to fund the cash flow promised on a charitable gift annuity. The Lord said it is better to give than to receive.

The amount of the annuity is fixed at the time of the gift and cannot be changed. This then allows the charity to utilize the remaining funds after. Charitable Gift Annuities for Charities CGAs entice hesitant donors to make a donation because they will receive something in return.

Complete all CGA administration reports. We offer deferred flexible and immediate gift annuity structures and the ability to outsource gift annuities. Usually regulation is under a states Insurance or Securities Laws.

125 rows Since 1955 the ACGA has targeted a residuum the amount remaining for the charity at the termination of the annuity of 50 of the original contribution for the gift annuity. A 75-year- old who establishes a charitable gift annuity after July 1 2020 will receive an annual payout of 54 which is down from 58 on January 1 of this year. You make the gift part of which is tax deductible and then you receive fixed annuity payments each year for the remainder of your life.

A charitable gift annuity CGA is a contract under which a 501 c 3 qualified public charity in return for an irrevocable transfer of cash or other property agrees to pay the annuitant s a lifetime income. In exchange the charity assumes a legal obligation to provide you and up to 1 additional beneficiary with a fixed amount of monthly income that continues until the last beneficiary dies. Frank Minton PhD the principal author of the Charitable Gift Annuities.

Receive income for life. The donor makes a lump-sum donation of cash securities or other assets. The maximum number of annuitants is two and payments can be made to them jointly or successively.

After your death the remainder of your gift is passed on to the ministries of your choice. By definition a charitable gift annuity is what is. ACGA is a contract to pay a fixed amount to one or two annuitants.

Charities may be required to comply not only with regulations in the state in which the charity does business but also in the state of residence of the donor. Charitable Solutions LLC in Jacksonville FL administers and works with the National Gift Annuity Foundation NGAF. We are a one-stop shop for any financial services organizations that offer charitable gift instruments and planned giving advice to wealthy investors.

In exchange for a gift of assets ie cash stock bonds real estate etc the donor s receive a lifetime income. Again the value of the IRA at the account holders death in included in the donors gross estate per the IRS but the estate may claim a charitable deduction for the portion exceeding the present value of the annuity. Ad A Significant Portion Of The Annuity Payment Will Be Tax Free Over A Number Of Years.

Gift annuities promote long-term relationships with donors. A charitable gift annuity is an agreement formalized as a contract between the donor and a charitable organization that establishes and maintains the annuity. Charities have some flexibility with the donation such.

After the death of the annuitant s the remainder of the gift is transferred to your designated charitys account at FFC. First published over two decades ago the CGA Manual is now a must-have reference for organizations and advisors who deal with gift annuities. Maintain complete accurate and confidential records for donors and other annuitants.

The Complete Resource Manual has long been recognized as the countrys leading gift annuity expert. Benefits of a charitable gift annuity Income stream for the rest of your life Immediate partial tax deduction based on your life expectancy and the anticipated income stream Potential for a portion of the income stream to be tax-free Possibility of donating many. Charities that offer charitable gift annuities should be aware that many states regulate the issuance of gift annuities.

A Charitable Gift Annuity CGA with NCF is a simple arrangement that involves a charitable gift and an annuity. Claremont McKenna College Offers Attractive Gift Annuity Rates And Secure Payments. With a charitable gift annuity you can do both.

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

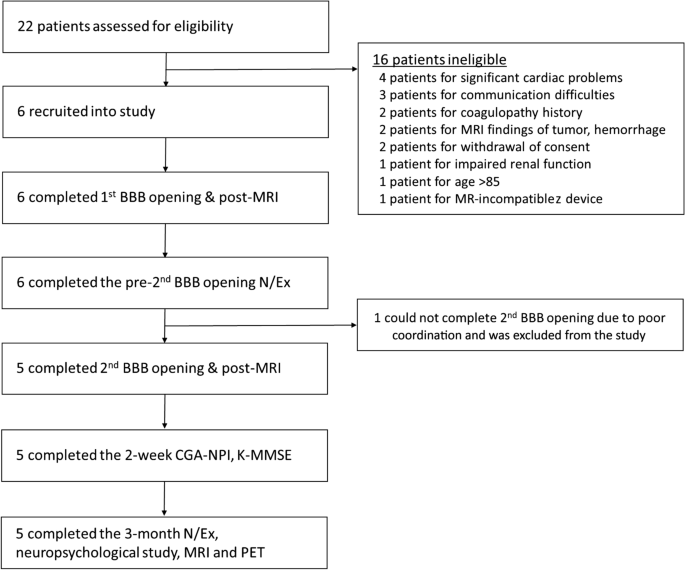

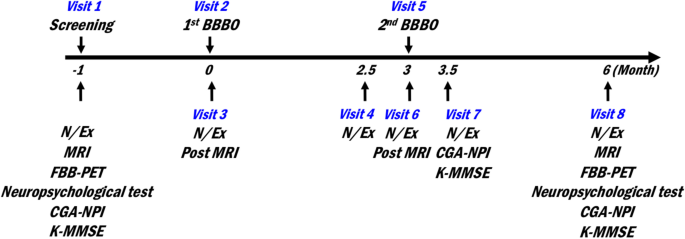

Extensive Frontal Focused Ultrasound Mediated Blood Brain Barrier Opening For The Treatment Of Alzheimer S Disease A Proof Of Concept Study Translational Neurodegeneration Full Text

Historic Swinging Bridge Story City Iowa Clapsaddle Garber Associates

Figure The Village Office Secretary Is Placed As A Staff Whom Is Download Scientific Diagram

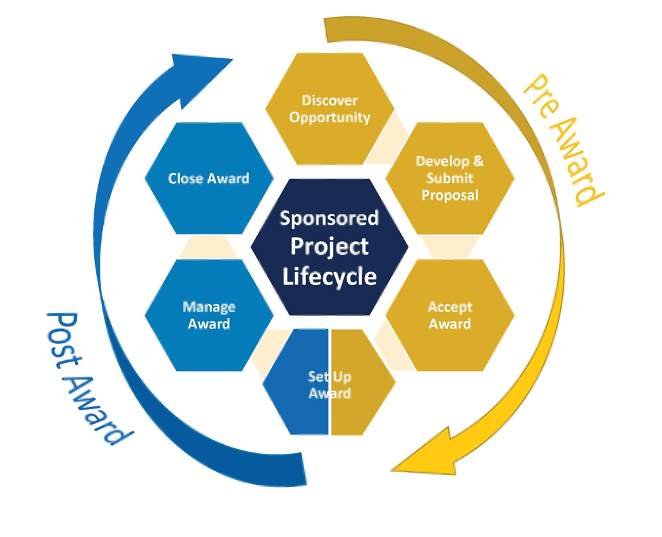

Develop Proposal Sponsored Projects Office

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Msu Office Of Sponsored Programs Contract And Grant Administration

Msu Office Of Sponsored Programs Contract And Grant Administration

Income Generating Gifts Harvard Medical School

Eu Social Partners In Central Governments Agreed A Joint Contribution To The Commission Consultation On Fair Minimum Wages Epsu

Create Income Now Princeton Alumni

Research Administration Berkeley Regional Services

Charitable Gift Annuities Barnabas Foundation

Installing Arcgis Harvard Graduate School Of Design

Extensive Frontal Focused Ultrasound Mediated Blood Brain Barrier Opening For The Treatment Of Alzheimer S Disease A Proof Of Concept Study Translational Neurodegeneration Full Text